Deposits FedNow

What is Deposits FedNow

Deposits FedNow and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Deposits FedNow for your business using Real-Time Payments

The Federal Reserve's FedNow Service provides a platform for instant, real-time payments, allowing businesses to receive deposits quickly and efficiently. Here's how businesses can leverage FedNow for receiving payments using "Request for Payment" (RfP):

What is FedNow?

FedNow is a real-time payment and settlement service developed by the Federal Reserve. It enables financial institutions of all sizes to offer safe and efficient instant payment services in real-time, 24/7/365. This service is designed to facilitate quicker payments between individuals, businesses, and governments.

Request for Payment (RfP) in FedNow

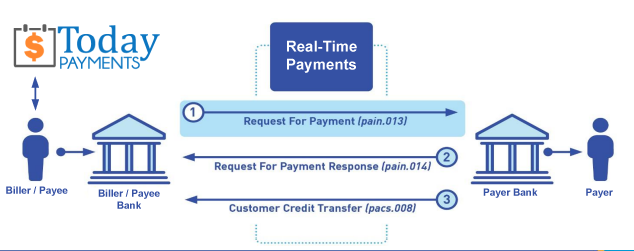

The Request for Payment (RfP) is a feature that allows payees (businesses) to request a payment from a payer (customer). This is akin to invoicing but in a digital and instantaneous manner. Here’s how it works:

- Initiating an RfP:

- The payee (business) sends an RfP to the payer (customer) via their financial institution. This request includes details like the amount owed, due date, and any relevant invoice information.

- Receiving and Approving the RfP:

- The payer receives the RfP through their financial institution’s digital channels (e.g., mobile app, online banking).

- The payer reviews the request and, if everything is in order, approves the payment.

- Processing the Payment:

- Once the payer approves the payment, the funds are transferred instantly from the payer’s account to the payee’s account via the FedNow Service.

- Both the payer and payee receive immediate confirmation of the transaction.

Benefits for Businesses

- Instant Access to Funds: Businesses receive payments in real-time, improving cash flow and financial planning.

- Reduced Processing Time: Eliminates the delay associated with traditional payment methods like checks and ACH transfers.

- Enhanced Customer Experience: Simplifies the payment process for customers, reducing friction and potentially improving customer satisfaction.

- Lower Costs: Potentially reduces transaction fees and administrative costs associated with processing payments.

Implementation Considerations

- Integration with Financial Institutions: Businesses need to work with their financial institutions to enable FedNow and RfP services.

- Technology Readiness: Ensuring that their payment systems and software can handle real-time transactions.

- Security Measures: Implementing robust security protocols to protect against fraud and unauthorized transactions.

Conclusion

Using FedNow and the RfP feature, businesses can significantly streamline their payment processes, ensuring they receive funds promptly and efficiently. This advancement not only enhances operational efficiency but also provides a more seamless and satisfactory payment experience for their customers.

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing